Context

Private Assets is a German private equity firm specialising in majority acquisition of underperforming companies with the aim to turn around their operations and drive growth. Julian, the firm’s Digital Operations Manager, is central to this transformation. Along with Florian, the Chief Digital Officer, he has been in charge of optimising the performance of newly acquired portfolio companies with digital solutions.

Challenge

The companies that Private Assets invest in often struggle with low digital maturity, relying heavily on manual processes that are inefficient and prone to errors.

Portfolio companies typically use dissimilar systems, making it challenging to consolidate structured data across the portfolio. That meant Private Assets and their portfolio companies spent hundreds of hours every month on repetitive and tedious tasks instead of focusing on operational efficiency. Ultimately this created delays in decision-making, which is crucial for Private Assets, as quick optimisations are essential to successfully turning around the portfolio companies.

"One of our biggest challenges was finding a solution that could handle our portfolio companies' complex and varied systems while being cost-effective and easy to use. We needed something that could deliver quick wins and long-term value."

Julian Atanassov, Digital Operations Manager

Julian and Florian had been testing numerous solutions before being introduced to Less. The recurring issue with other solutions had been that they were either too costly, too time-consuming to implement or required a heavy investment in technical staff to implement. Altogether, rendering them unfit Private Assets position and ambitions.

Solution

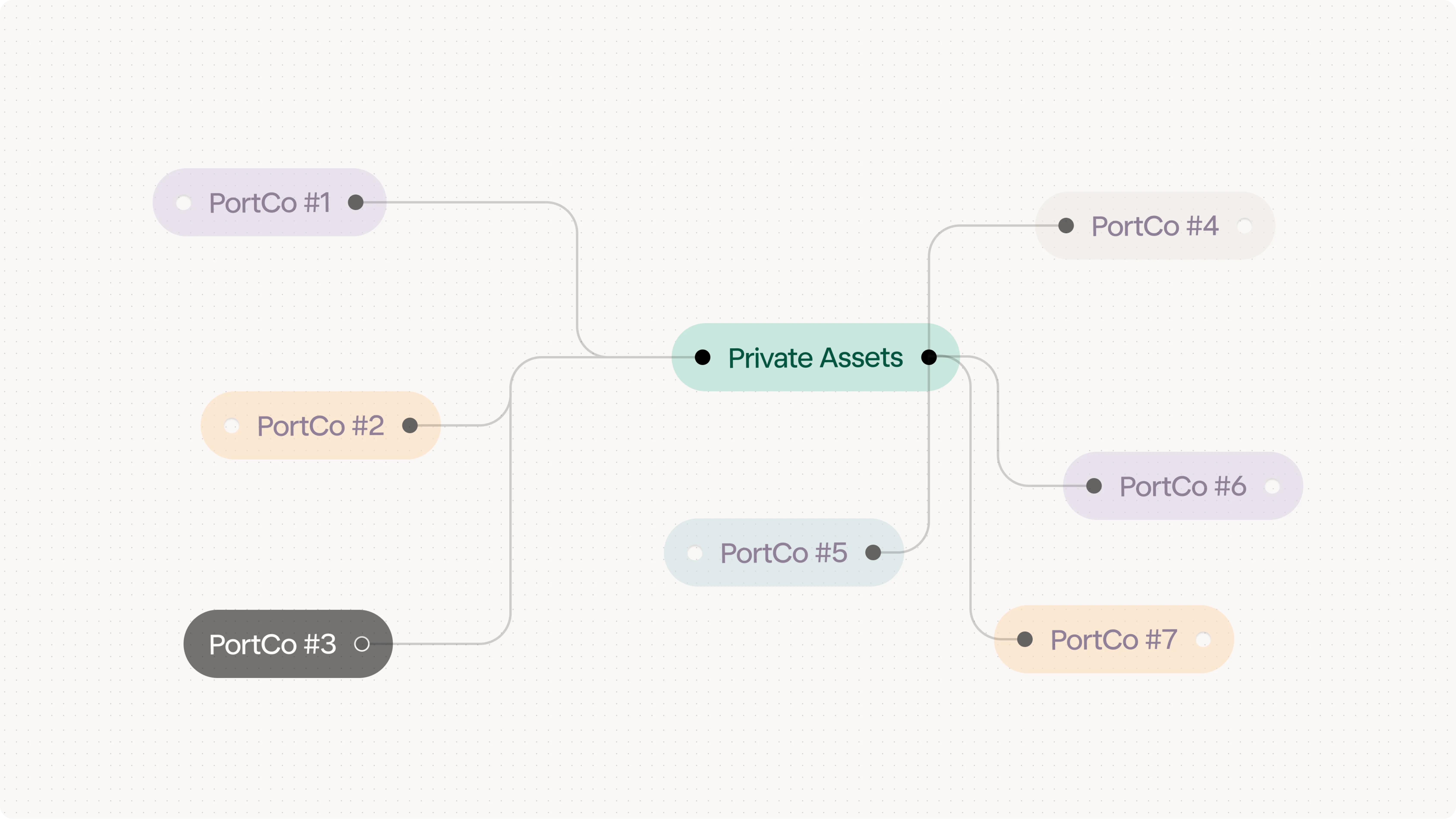

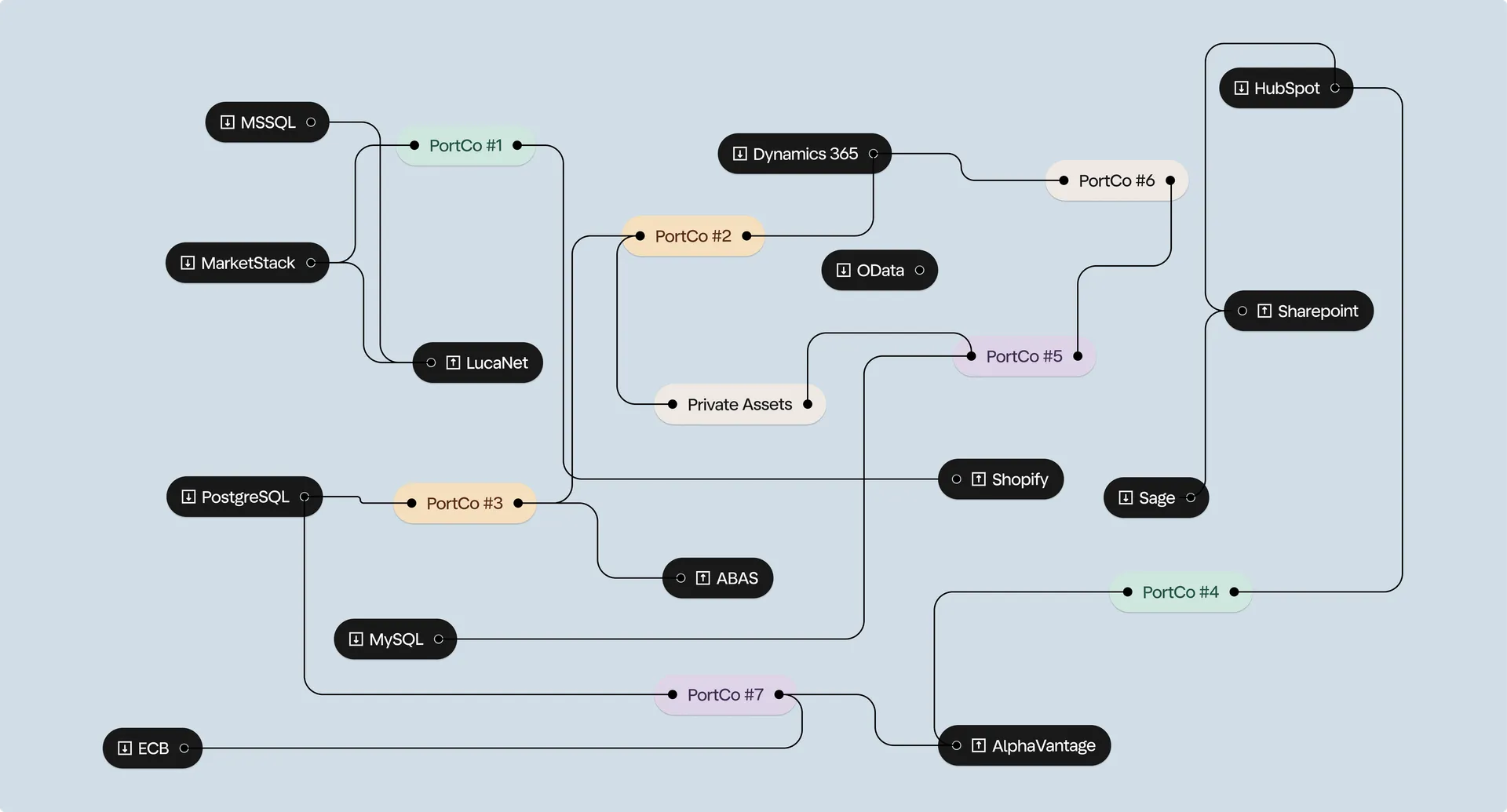

Private Assets learned about Less in December 2022. With the help of Pyne - a Less implementation Partner - Julian and Florian quickly introduced Less as a proof-of-concept in a selected portfolio company. The proof-of-concept quickly delivered results. Three months after the kick off of the project, Private Assets began implementing Less in their second portfolio company. To date, the team has implemented Less in seven portfolio companies.

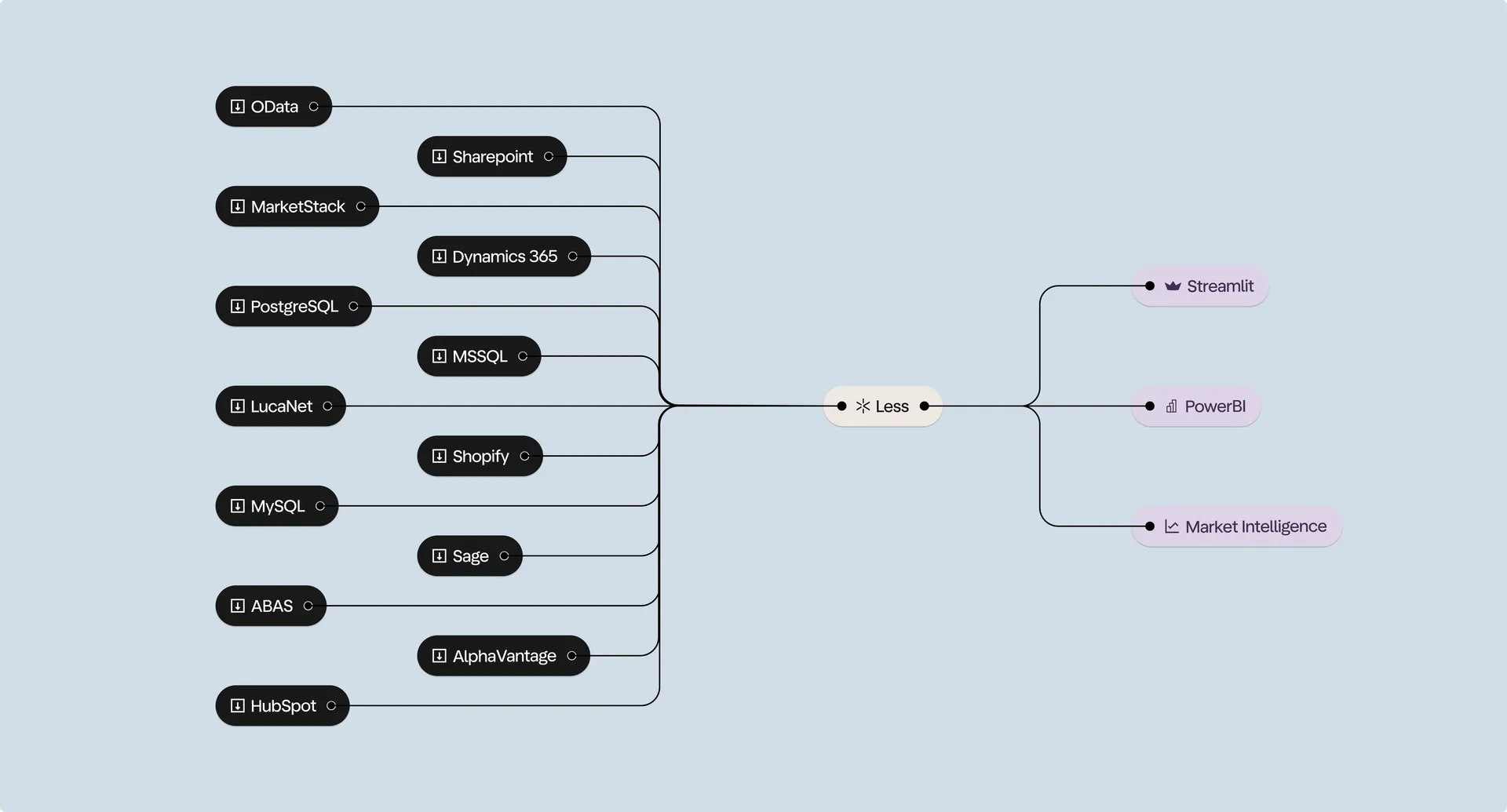

One of the solution’s central pieces has been that the Less helps seamlessly extract data from a wide range of data sources, including ERPs, accounting software, SharePoint, HubSpot and a number of public data sources. That allowed the team to build live financial consolidation, showcasing critical metrics like net working capital, current assets, accounts receivable/payables and revenue for each portfolio company and consolidated across the portfolio. All of which is entirely automated with daily updates.

In addition to financial consolidation, Less enabled the creation of dashboards in each portfolio company. For example, a cast iron component manufacturing company used Less to identify an irregularity in its production line, leading to a 2.3% increase in production output—equivalent to hundreds of thousands of euros in additional revenue. Another portfolio company built a Streamlit application powered by Less to gather daily performance data from warehouse staff, further enhancing operational efficiency. At a third portfolio company, Chris Farrell, which specialises in medical cosmetics, the team has concentrated on using Less to power dashboards for their sales department. According to Managing Director Dominik Schlammerl, the implementation of Less has led to substantial revenue growth.

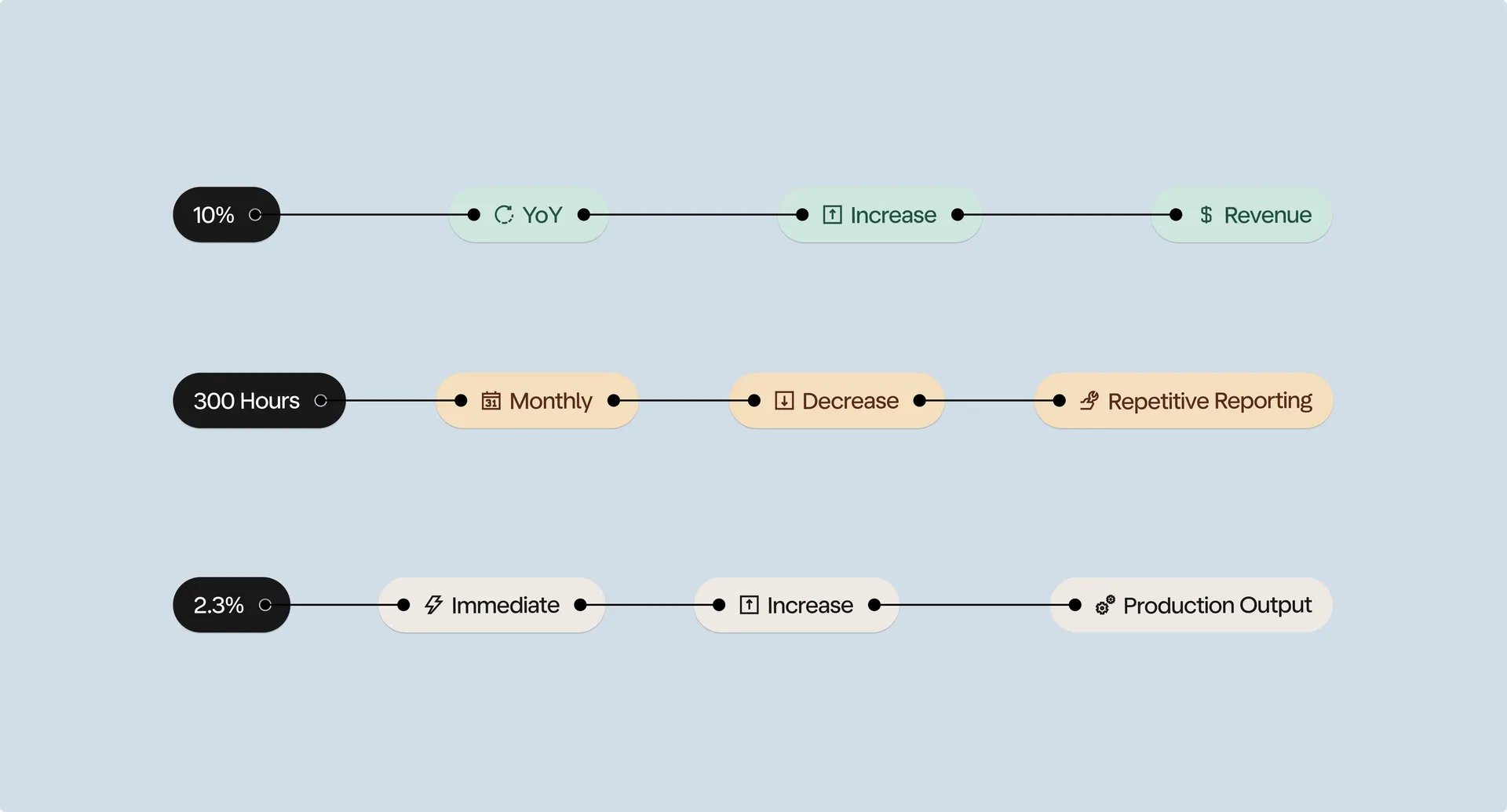

"Less has substantially contributed to increasing our revenue by 10% YoY. We now have full transparency around our sales efforts which significantly boosts decision-making, motivation and, ultimately, our top line"

Dominik Schlammerl, Managing Director @ Chris Farrell

Moreover, Less was instrumental in integrating financial market and macroeconomic data from sources like DeStatis, BBk, OECD, Marketstack, and the ECB, providing the management team at Private Assets with comprehensive insights into market trends and their potential impact on the portfolio.

"Less has been a pivotal solution for us. It has not only streamlined our operations but also provided us with the insights needed to make informed decisions quickly"

Julian Atanassov, Digital Operations Manager

Results

The implementation of Less resulted in significant improvements across the portfolio:

- Operational Efficiency: By automating repetitive tasks, Private Assets estimates that their portfolio companies saved a combined 300 hours per month.

- Increased Revenue: Insights derived from Less led to a 2.3% increase in production output at one portfolio company, directly impacting the top line.

- Live Monitoring: The management team at Private Assets gained a live overview of the performance of all assets, enabling more informed decision-making.

- Enhanced Portfolio Value: The value of the portfolio companies increased, positioning them for successful exits and/or improved EBIT, thanks to the implementation of data analytics and automation. This increase in value was achieved with minimal additional investment, leveraging the long-term value horizon of private equity.

“Partnering with Less has transformed the data culture within our portfolio companies. Our collaboration has been instrumental in driving growth and operational efficiency"

Florian Feddeck, Chief Digital Officer

Most importantly, the Private Assets team has done all of that without extensive technical resources, proving that effective digital transformation doesn’t require deep technical expertise or significant operational costs. Julian notes that “the alternative to Less would have been a team of three Data Analysts”.